With an annual inflation rate of 8.2%, volatile stock markets, record-high gas prices, and rising interest rates, there are many factors that are dampening consumer sentiment in the United States. An economic slowdown will impact everyone, and each household will feel it differently. America’s economy shrank in the first three months of 2022. Although the gross domestic product has turned slightly positive in recent months, 2023 isn’t shaping out to be much better. How will a recession impact car sales? How will car buyers be affected by a recession in 2023 or 2024? Will it be the same as 2008, or are things different this time around?

What Happens to Auto Sales in an Economic Recession?

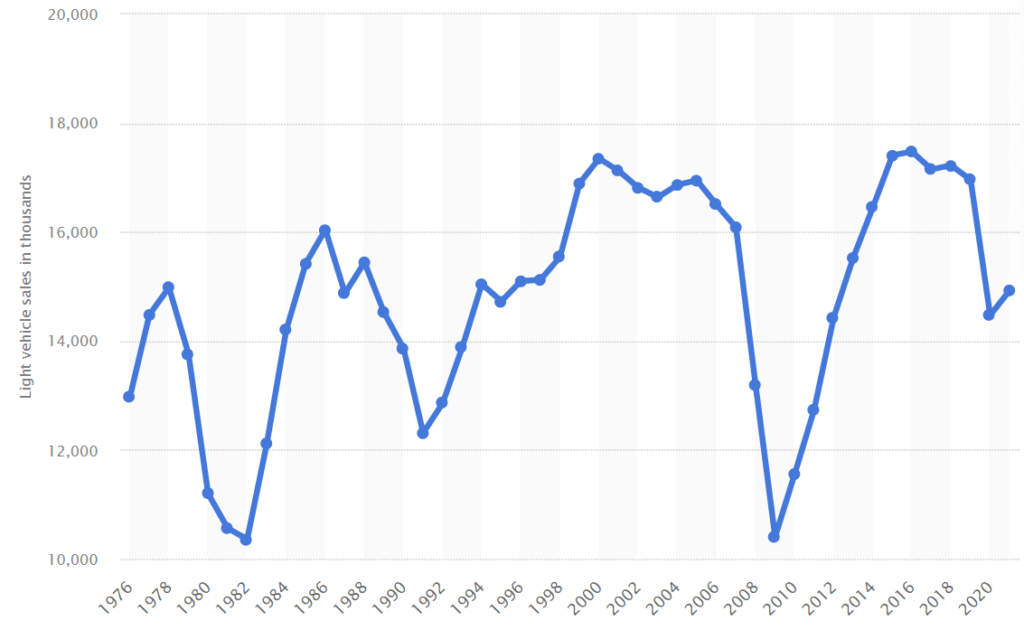

For most, the mere mention of a recession is cause for cutting back, saving money and spending less. Discretionary spending, essentially spending by choice rather than by need, always plummets in a recession. For some households, discretionary spending includes that shiny new car you’ve had your eye on. For others, a car is essential for work, etc. In a recession, auto sales decline significantly as many buyers back out of the market. However, a recession in 2023 is not going to be the same for car buying as it was in 2008 and 2020.

New vehicle sales in the U.S. fell nearly 40 percent during the ‘Great Recession’ of 2008. Gas-guzzlers were hit the worst, and hybrid powertrains made their big break. 2020’s pandemic-driven recession was the shortest in history, lasting just two months. Even then, auto sales were down 15 percent compared to 2019.

What’s different now? New car inventory is at record lows. If you’ve seen those empty dealer lots, you’re well aware. In the 2008 recession, there was an overabundance of new car inventory, and little demand. Today, the demand for new and used vehicles far exceeds the supply of vehicles. If a recession weakens the demand for cars, it may drive prices down slightly, but it won’t be a massive decrease in car prices like we saw in 2008 and 2020.

If you’re thinking about selling, you should decide sooner rather than later. We track used car prices weekly, and we’ve seen 4 months of declines on wholesale markets.

Soon enough, lower used car prices will likely spill over to retail markets. On the other hand, those thinking of buying could save thousands of dollars by waiting a month or two. New car inventory remains very low, but there are signs that it’s improving. An economic recession may help to increase inventory as buyers pull back on spending.

How Will a Recession Affect Electric Vehicle Sales and Availability?

Demand exceeds the supply of electric vehicles, and that will cushion the effects of a recession on EV sales and prices. EV market share has hit record highs, and dealers and direct-to-consumer automakers are having no problem selling every EV they have. The severity of this recession will determine the magnitude of effects on EV sales and pricing. If we start to see car sales decline by 20% or more, we could see price reductions. Still, here’s why that’s unlikely to happen. We’re seeing the highest rates of inflation in 40 years, so automakers are paying more to build electric cars, and can’t afford to lower MSRPs. Lithium prices are through the roof, so EV batteries are much more costly to produce.

Ford executives recently admitted that inflation and the subsequent increase in cost for raw materials has eliminated the narrow profits Ford had been making on the Mustang Mach-E. They’re no longer turning a profit on their EVs.

In summary, don’t expect an economic recession to lower EV prices unless it becomes a severe recession, and inflation eases significantly. Tesla’s repeated price drops are the biggest factor affecting EV prices in 2023.

Here’s the latest EV price update – including average prices for top models.

With the average electric vehicle transaction $10,000 more than the average combustion-powered vehicle, EV incentives are a big factor in deciding whether or not EVs make sense for your bottom line. Here’s the latest on federal EV incentives and the best state incentives.

Our prediction, based on the latest data, is that a slight economic recession will be with us for 12+ months and that we’re already in the beginning stages of it.

0 Comments